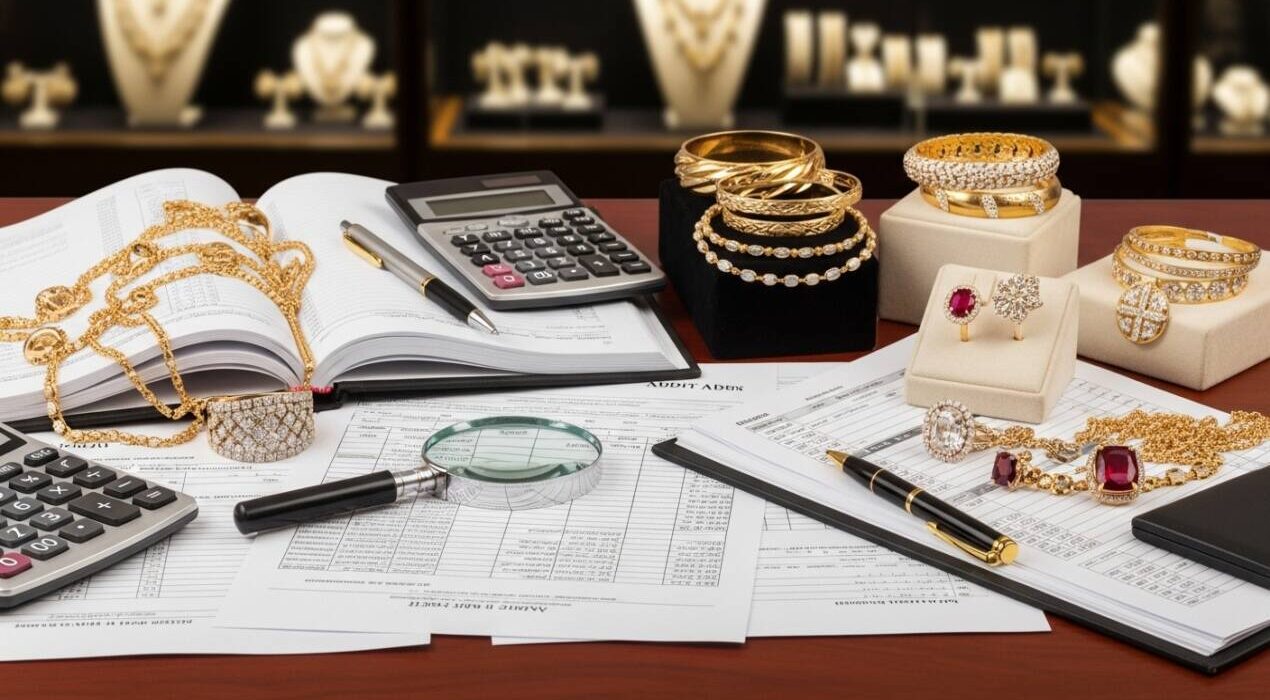

The Federal Board of Revenue (FBR) has initiated a major crackdown on tax evasion within Pakistan’s jewellery sector, after compiling detailed data on more than 60,000 jewellers nationwide. The move comes as part of the authority’s broader strategy to ensure greater compliance and expand the country’s tax base.

According to officials, a significant proportion of jewellers are not declaring their actual earnings. Out of the 60,000 jewellers identified, only about 21,000 are officially registered with the tax authority, while an even smaller number just 10,524 have filed their income tax returns. This wide gap highlights the extent of non-compliance within the sector, which has long been considered a hotspot for underreporting income and avoiding taxation.

In the first phase of this operation, the FBR is paying particular attention to major commercial hubs in Punjab, including Lahore, Rawalpindi, Faisalabad, and Multan. A specific list of 900 jewellers operating in these cities has already been prepared. Notices have been issued to these traders, requiring them to justify income declarations that appear inconsistent with their visible business activities, spending patterns, or general lifestyle.

Officials explained that a large number of jewellers either have not registered with the FBR at all, or are reporting unrealistically low levels of income compared to their sales volume and evident financial status. Those who fall under suspicion are being contacted directly and asked to provide clarification. If discrepancies persist, stricter action may follow in later phases of the campaign.This action against jewellers comes soon after the FBR signaled similar scrutiny for individuals who showcase extraordinary wealth on social media or spend lavishly on events such as weddings. In such cases, the tax authority intends to cross-check whether these individuals are registered filers and if their declared incomes align with their visible lifestyles. Even non-filers who indulge in luxury purchases, such as suits worth thousands of dollars, could be brought under investigation.

.