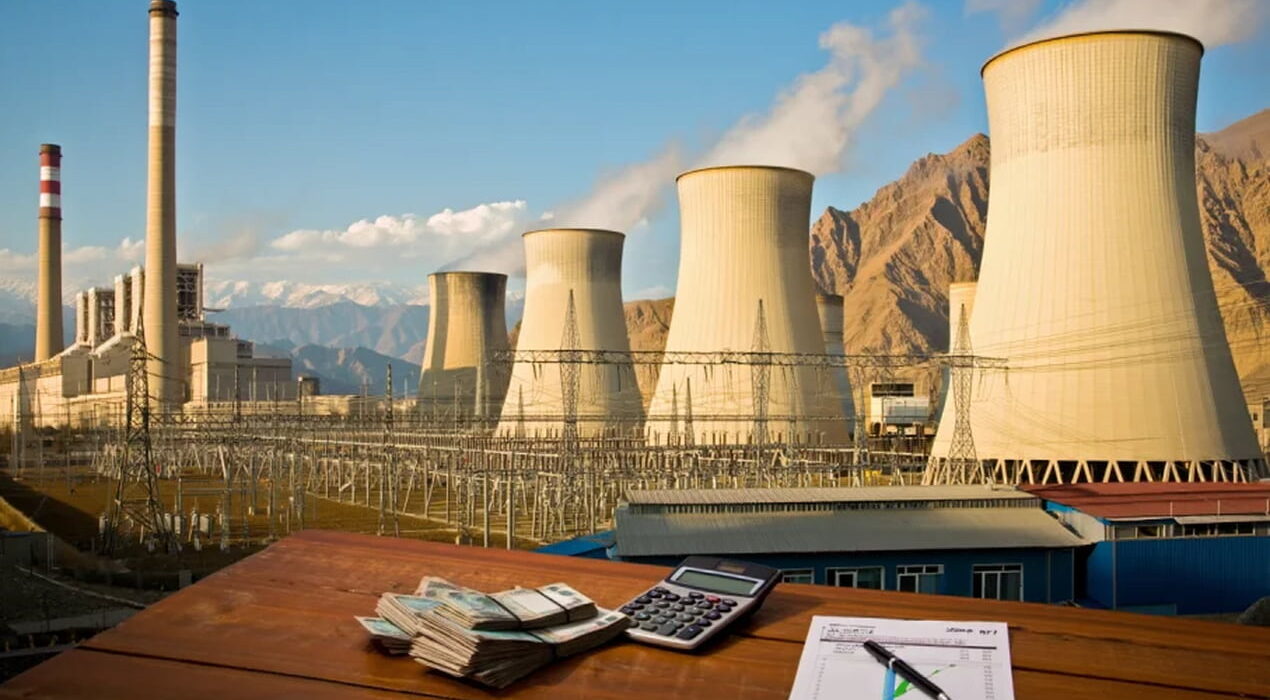

In a significant move to tackle Pakistan’s long-standing power sector crisis, the federal government has finalized a Rs1.275 trillion financing deal with a consortium of 18 commercial banks at favorable interest rates.

The signing ceremony was held at the Prime Minister’s Office (PMO) in Islamabad, while Prime Minister Shehbaz Sharif attended virtually from New York, where he is participating in the United Nations General Assembly.

Under the arrangement, the government will secure funding at 3-month KIBOR minus 0.9%, ensuring reduced borrowing costs. Repayment will be managed through the existing surcharge of Rs3.23 per unit included in consumer electricity bills.

Unlike earlier strategies that simply capped circular debt levels, this plan emphasizes gradual debt reduction through structured bank financing. A press release by the Finance Ministry stated that the agreement was made possible through collaboration between the Prime Minister’s Task Force on Power, the Ministry of Energy, the State Bank of Pakistan, the Pakistan Banks Association, and 18 lending banks.

Funds from the deal will cover outstanding dues of Independent Power Producers (IPPs) and the liabilities of the Power Holding Company. Of the total, Rs683 billion is earmarked for the Power Holding Company, while Rs592 billion will go toward IPP payments.

The loan will be repaid over 24 equal quarterly installments. To manage risks, an annual repayment ceiling of Rs323 billion has been set, with a total cap of Rs1.938 trillion in case of interest rate hikes.

This financing package is aligned with Pakistan’s $7 billion IMF reform agenda, which focuses on curbing circular debt and improving the efficiency of the power sector.

Pakistan Strikes Rs1.275 Trillion Loan Deal to Ease Power Sector Circular Debt