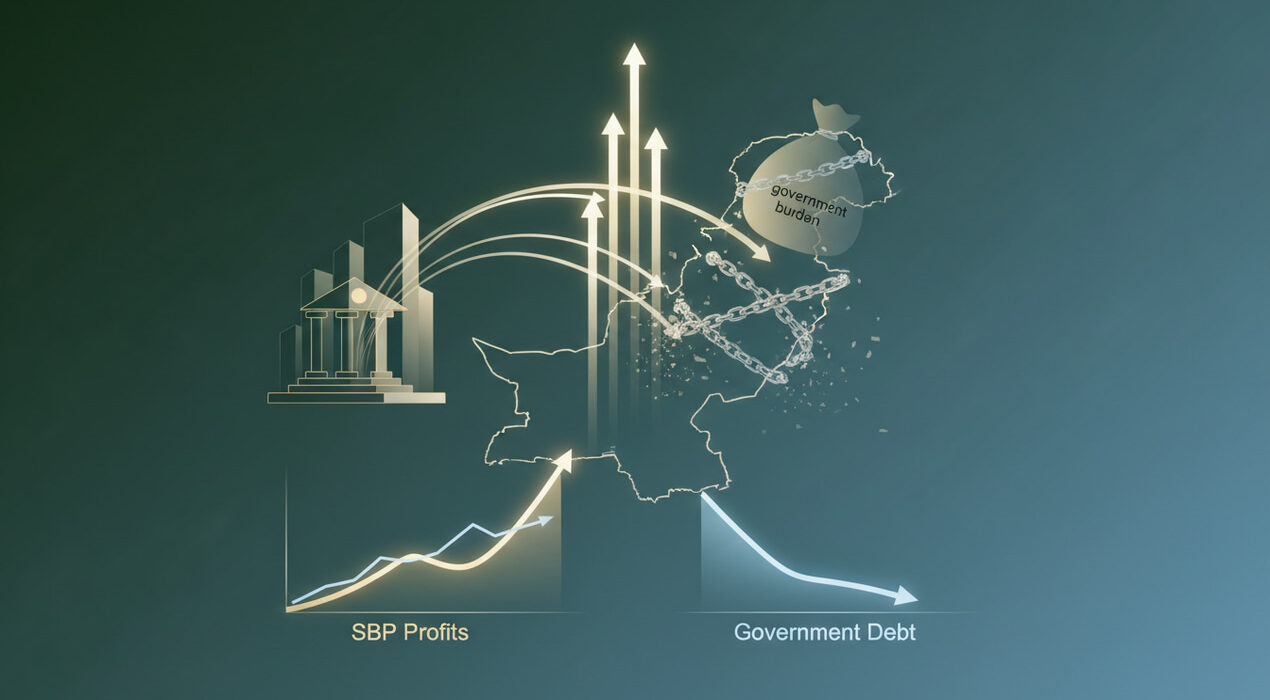

SBP Profit Impact Helps Pakistan Reduce Government Debt in Early FY2026

Pakistan saw a notable improvement in its fiscal position during the first quarter of FY2026. The SBP profit impact played a major role in this early shift. As a result, the government managed to reduce its overall debt and build fresh confidence in the economy.

Official data showed a sharp drop in total public debt between July and September. The figure fell to Rs76.605 trillion by the end of September 2025. This marked a decrease of Rs1.283 trillion from June.

Domestic and Foreign Trends

Domestic debt led much of this improvement. It declined by Rs1.048 trillion and moved down to Rs53.424 trillion. Long term borrowing also eased during this period. It dropped to Rs44.961 trillion after falling by Rs692 billion. Short-term borrowing slid as well, settling at Rs8.4 trillion. However, Naya Pakistan Certificate holdings rose slightly and reached Rs63 billion.

External debt also moved lower. It decreased by Rs236 billion and touched Rs23.181 trillion by September. Analysts said this trend reflected better financial planning and disciplined payments. In addition, they highlighted how strong central bank profits supported this change.

The State Bank transferred Rs2.4 trillion from its Rs2.5 trillion earnings to the federal government. This transfer eased pressure on the national balance sheet. Therefore, the government gained more flexibility to maintain stable spending.

Experts added that controlled budgetary borrowing created room for private sector credit. This shift could support investment growth in the coming months. In addition, it may help businesses plan more confidently.

Positive Economic Signals

The early reduction in government debt sent encouraging signals to markets. Lower debt reduced concerns about interest payments. As a result, the government can focus more on development and inclusive economic progress.

Economists believe this momentum could strengthen fiscal stability. They also expect improved investor sentiment if these trends continue. However, they emphasise the need for steady reforms to maintain balance.

Overall, the first quarter offered a hopeful start to FY2026. The combination of financial discipline, better planning, and the SBP profit impact created a more stable path forward. Pakistan now enters the next quarter with a stronger position and a clearer outlook.