Apple Q.ai Acquisition Nears $2B Deal in Major AI Strategy Shift

The Apple Q.ai acquisition is reportedly close to completion, with the deal valued at nearly $2 billion. If finalized, it would become the largest acquisition in Apple’s history. The move signals a significant shift in the company’s traditionally cautious M&A strategy.Q.ai is an Israeli artificial intelligence startup that specializes in machine-learning optimization. The company focuses heavily on on-device AI, where models run directly on hardware instead of cloud servers. This approach aligns closely with Apple’s privacy-first philosophy.

By processing AI tasks on-device, companies can reduce reliance on external data centers. As a result, users benefit from faster performance and stronger data protection.

Why This Deal Matters for Apple

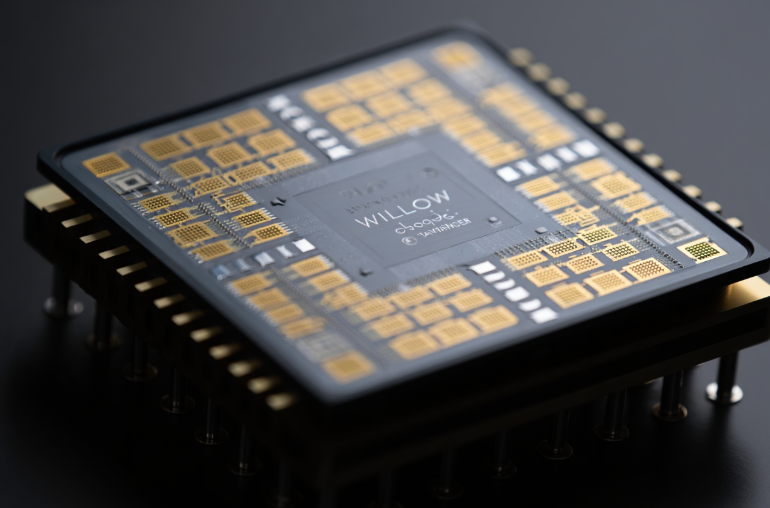

Apple faces mounting pressure from competitors that aggressively deploy generative AI across search, productivity tools, and consumer devices. While Apple has invested in custom silicon and software integration, critics argue it has not demonstrated visible AI leadership at the same scale as rivals. The Apple Q.ai acquisition would immediately add experienced AI engineers, proprietary algorithms, and valuable patents to Apple’s ecosystem. Analysts expect the technology to enhance iPhones, Macs, wearables, and even future mixed-reality products.

In addition, deeper AI integration could strengthen Apple’s hardware-software synergy. The company already designs its own chips, which could optimize machine-learning workloads more efficiently.

Industry observers view this deal as a turning point. AI has become a foundational platform technology rather than a simple feature upgrade. Therefore, rapid AI scaling may prove critical for Apple’s competitiveness in what many call the post-smartphone era. If the acquisition moves forward, it could reshape Apple’s long-term innovation roadmap and reinforce its position in the evolving global AI landscape.