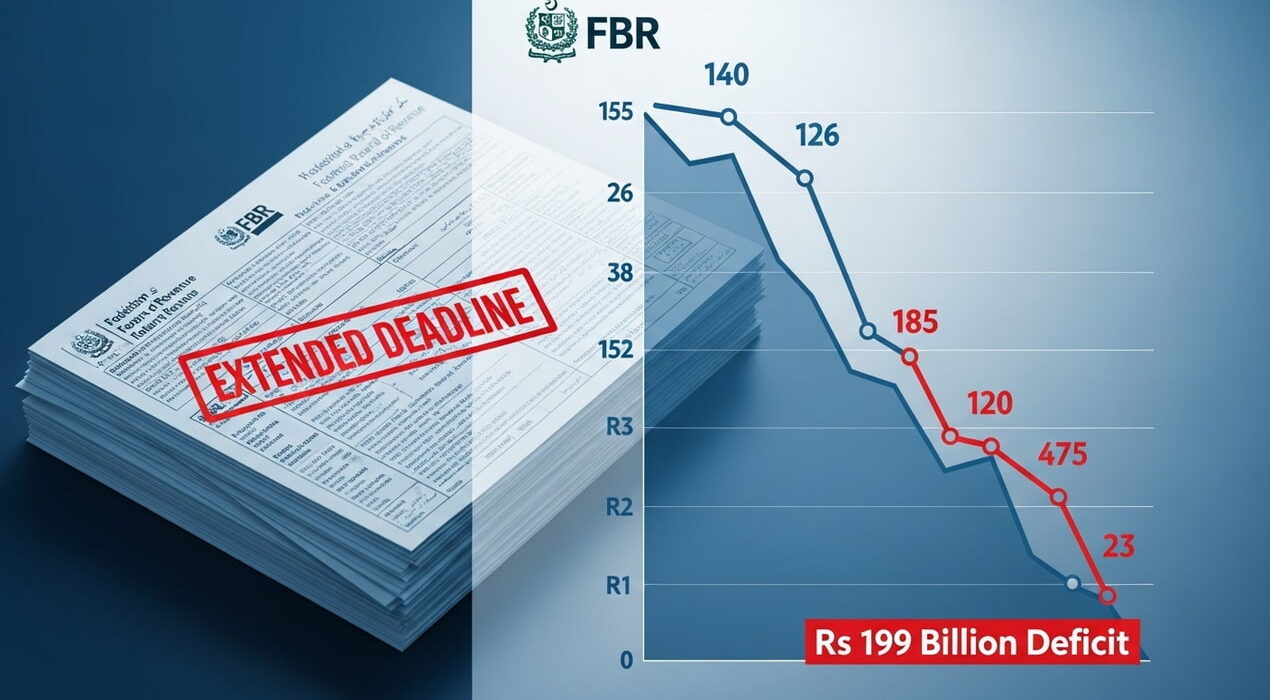

Pakistan’s tax revenue fell short of expectations in the first quarter. The Federal Board of Revenue (FBR) missed its July–September target by Rs199 billion.

Against a target of Rs3,083 billion, collections stood at Rs2,885 billion. Heavy floods severely impacted tax collection, causing an estimated loss of Rs60 billion.

Revenue Breakdown

In September alone, the FBR recorded a shortfall of Rs156 billion. Despite the setback, refunds worth Rs157 billion were also issued during this period.

According to official data, income tax generated Rs1,395 billion. Sales tax added Rs1,130 billion. Federal excise duty contributed Rs190 billion, while customs duty brought in Rs324 billion.

Deadline Extended for Tax Returns

In a separate move, the FBR extended the deadline for filing Income Tax Returns until October 15. This step aims to provide relief to taxpayers facing challenges.

The extension came after demands from the business community. Earlier, September 30 was the last date for filing. However, many taxpayers sought extra time due to recent difficulties.

So far, around 400,000 people have submitted their returns. The FBR confirmed that individuals can use a simplified online form available on its website.

Therefore, taxpayers now have two additional weeks to complete their filings. The extension reflects the government’s effort to ease the process during a tough economic period.